After its passage by narrowest of margins within the Home of Representatives, Republicans’ “massive, stunning” finances reconciliation invoice is going through the prospect of main modifications within the Senate, which might make it extraordinarily tough to cross when the revised invoice is returned to the Home.

Have you ever taken your home on the wall?

The invoice handed the Home by a 215-214 margin with one “current” vote after last-minute offers had been made to appease fiscal hawks and blue-state Republicans who demanded greater state tax deductions.

It could fulfill plenty of President Donald Trump’s marketing campaign guarantees, reminiscent of funding border safety and extending his first-term 2017 tax cuts.

Rep. Roy on @glennbeck: “There are forces at play which might be desperately attempting to undo the advantages [the House] acquired with respect to repealing the Inexperienced New Rip-off subsidies… which [Trump] campaigned totally and clearly on terminating. There are forces within the Senate who need to undo… pic.twitter.com/KtY7cFCcQC

— Rep. Chip Roy Press Workplace (@RepChipRoy) June 4, 2025

Rep. Chip Roy, R-Texas, who voted for the invoice after last-minute talks with Home management and the president, warned Wednesday that the invoice could be lifeless within the water if the Senate made it much less fiscally conservative.

“If this invoice backslides, in the event that they again off of what we acquired, which I don’t even assume is essentially ok, I can promise you I’ll oppose it within the Home,” he stated.

Are GOP Senators Contemplating Home’s ‘Purple Strains’?

However some within the Senate counsel they are going to do the other and ship much more spending cuts than the Home.

Requested by The Every day Sign if he nervous about vote margins within the Home if cost-saving provisions are eliminated, Sen. Lindsey Graham, R-S.C., replied, “I believe the Senate making the invoice extra fiscally accountable will truly assist with the Home.”

.@LindseyGrahamSC tells @DailySignal that making the large, stunning invoice extra conservative within the senate would assist guarantee passage within the Home pic.twitter.com/UthyZw2hme

— George Caldwell (@GCaldwell_news) June 5, 2025

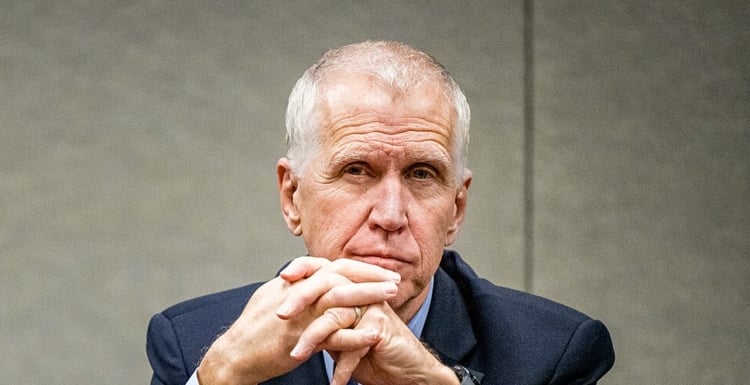

Sen. Thom Tillis, R-N.C., scoffed on the thought of “purple strains” that may’t be crossed.

“Look, I’ve seen quite a lot of purple strains erased and redrawn within the Home. What we have to do is persuade the president we now have a stable invoice, they usually can have that dialogue with the president if we get his help for what we’re going to ship to the Home. That’s how this place works, no sense in sugarcoating it,” he advised The Every day Sign.

“The underside line is, we’ve acquired to get this invoice achieved. Individuals can discuss it, however on the finish of the day, you’re going to have a vote on the ground, and we’ll see how purple that line is.”

Tillis did say, nonetheless, that Home fiscal hawks could be received over with rescissions packages—a sort of invoice exempt from the Senate filibuster, which permits for slicing spending by a easy majority vote, reasonably than a 60-vote supermajority.

The White Home lately delivered $9.4 billion in really helpful cuts to the Home, however Tillis says he wish to see “tens of billions in rescissions, primarily based on work the DOGE have achieved.” DOGE is the Division of Authorities Effectivity.

“I believe that can deal with among the considerations of the Home actual quick. I imply, fairly actually, I would like extra cuts out of the Senate than they delivered within the Home.”

The Meals Stamp Difficulty

There are numerous cost-saving provisions within the Home invoice which might be coming underneath scrutiny by Republican Senators.

One such difficulty is the way in which the invoice finds saving within the Supplemental Vitamin Help Program (SNAP) by requiring states to share extra of the price of meals stamps.

Sen. Tommy Tuberville, R-Ala., advised The Every day Sign he’s nervous Alabama received’t be capable of afford that.

“I’m a type of 11 states that almost all of our finances is taken up by Medicaid. If we now have to begin spending $100 [million], $200 million on SNAP, we acquired issues,” he stated.

However Tuberville is aware of the razor-thin margin within the Home, the place eliminating such a provision might jeopardize the invoice’s passage. He clarified that he desires to see the general program lowered.

“What I need to do is see it reformed to the place we don’t have as many individuals on SNAP. It’s not purported to be a full-time entitlement program. And what’s going to occur is, all of the blue states are going to have all these full-time folks on it, and other people within the Southern states are going to pay for it. So, we have to make it truthful,” stated Tuberville, who has introduced his intention to run for Alabama governor subsequent 12 months.

After all, Democrats revile the thought of states sharing the next cost-burden from SNAP.

It will likely be “devastating on this system, devastating on the states and positively devastating on the wants of on a regular basis Individuals,” Sen. Peter Welch, D-Vt., a member of the Senate Committee on Agriculture advised The Every day Sign when requested about states sharing greater SNAP prices with the federal authorities.

Sen. Tillis’ Objections

Tillis is a major instance of a Republican who wish to see main modifications to the invoice, lots of which might anger Home finances hawks and different teams.

He helps slower expiration dates for Biden-era inexperienced power tax credit, for one factor.

However Roy has already stated that transferring again the early expiration dates that he pushed for would harm a invoice that’s “on the sting of whether or not it’s ok to advantage transferring ahead.”

Tillis additionally stated Medicaid reforms can’t be too extreme, because the president “doesn’t need to hurt certified beneficiaries on any of the protection web packages.”

But when Tillis is against spending cuts carried out that means, how can he declare to need extra financial savings than the Home?

“Everybody makes use of [waste, fraud and abuse] as a tagline, only a few folks know the best way to [get rid of] it. I did it for a dwelling as a companion at PriceWaterhouse,” he advised The Every day Sign, referring to the enormous accounting and consulting agency.

“There are huge financial savings available if we create packages and we offer folks know-how and infrastructure to do it. Should you simply do nothing greater than leverage the analytics packages that CMS has, and also you get a superb program workplace in there, you’ll be able to in a short time drive out financial savings,” he stated, referring to the Facilities for Medicare and Medicaid Companies.

However Tillis has nonetheless extra concepts on reconciliation which might be more likely to irk different factions, even those that are exterior of the finances hawk faction of the Home.

For one, he opposes the $40,000 cap on state and native tax (SALT) deductions—a coverage principally benefiting residents of high-tax blue states, who can then deduct native taxes on their federal tax returns.

Home management’s SALT deal was an especially contentious course of that allowed the invoice to simply barely squeak by within the decrease chamber. 4 New York Republican representatives—sufficient to tank the invoice—beforehand stated they wouldn’t vote for a invoice if the cap was set at $30,000. It’s at the moment $10,000.

“I hope not,” Tillis stated, when requested if the $40,000 cap might keep.

“That’s one the place I don’t—once I draw a purple line, I stick with it—I don’t need to draw a purple line there, however in whole I might be loads happier seeing that quantity come down,” he added.

He additionally has his criticisms of the “no tax on suggestions” provisions, though he says that he doesn’t assume it will likely be everlasting.

“I don’t assume it will likely be a part of the everlasting tax coverage,” he stated.

“The difficulty I’ve with any of these kinds of provisions is equity … the waiter’s going to get a tax break, however the warehouse employee isn’t. So, I’m not against perhaps offering a tax reduction, however I would really like for it to influence all people at that very same socioeconomic strata.”

What’s going to come of those competing congressional pursuits stays to be seen as Senate Republican management rushes to cross the invoice by its self-imposed deadline of Independence Day July 4.

Passing the invoice by the Senate can be tough, however it’s seemingly the debates will solely develop louder if the invoice is distributed to the Home in a considerably completely different type.

How are you praying concerning the Huge, Lovely Invoice? Share your ideas and prayers under.

This text was initially revealed at The Every day Sign. Photograph Credit score: Metropolis of Greenville, North Carolina – Group Venture Funding, Public Area, https://commons.wikimedia.org/w/index.php?curid=147649410.